Actual tax payable ET. Will the underestimation penalty under Section 107C10 of the ITA be imposed if the companys final tax liability per the tax return exceeds the revised estimate of tax payable by.

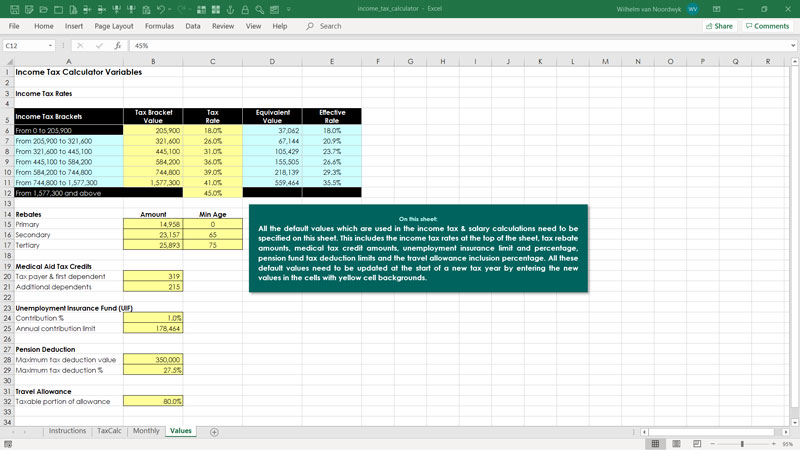

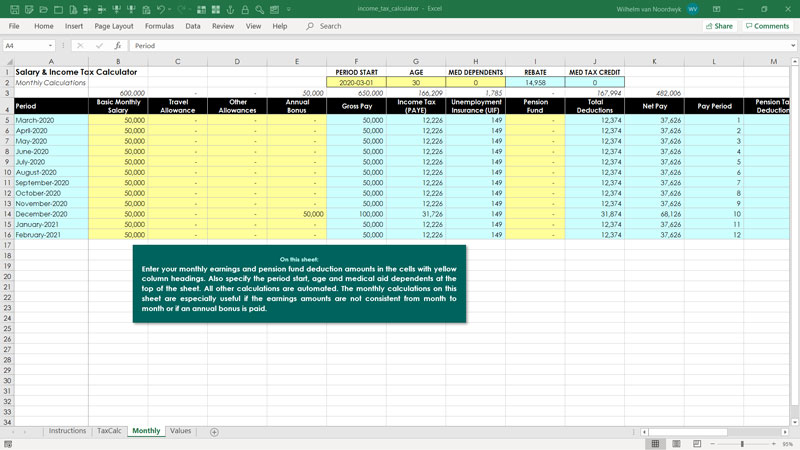

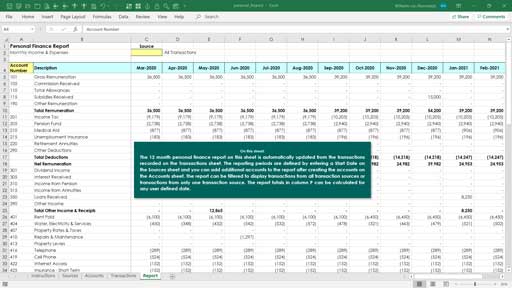

Computation Of Income Tax In Excel Excel Skills

Check your Income Tax payments for the current year.

. Example 1 - Determination of an estimate of tax payable. The initial estimate of tax payable for YA 2022 must not be less than 85 of the initial or revised estimate of tax payable in the sixth or ninth month of the basis period for YA 2021. Ask your employer if they use an automated system to submit Form W-4.

After You Use the Estimator. Amount of tax to be increased at - et - 30 x at x 10 where. For companies that were newly incorporated the tax payable estimate must be given within 3.

Actual tax payable ET. To change your tax withholding amount. Now this is how you calculate the tax.

CP204 Due Date of the Submission Monthly Instalment based on Form CP205. Check how much you paid last year 6 April 2021 to 5 April 2022 estimate how much you should have paid in a. Or keep the same amount.

The company must determine and submit the tax payable estimation for an assessment year through Form CP204. See What Credits and Deductions Apply to You. Submit or give Form W-4 to.

This should be beyond 30 days before the basis period starts. Kindly remind that where the tax payable for a particular year of assessment exceeds the estimate of tax payable by an amount of more than thirty per cent 30 of the tax payable under the final assessment then without any further notice being served the difference between that amount and thirty per cent 30 of the tax payable under the final assessment shall be increased by. For the 201920 to 202122 income years the calculator will estimate your tax payable and calculate your.

When figuring your estimated tax for the current year it may be helpful to use your income deductions and. Deduct the Personal exemption 4050. Revised estimated tax payable or estimated tax payable if no revised estimate is furnished Penalty for Late Payment.

Ad EZ to use online fuel tax program is fast affordable. Standard deduction for a single person 6350. Deduction for half of the self-employment tax 565182.

5How to do for the revision of CP204. 80000 x 09235 x 153 Social Security and Medicare 1130364. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Use your estimate to change your tax withholding amount on Form W-4. Do it yourself 25 qtr. Amount of tax to be increased AT-ET - 30 x AT x 10 where.

There are different ways to. Revised estimated tax payable or original estimated tax payable if no revised estimate furnished. E-Estimate Login e-CP204 Change Password Forgot Your Pasword Print Form Acknowledgement Verify Digital Certificate Challenge Phrase Change DirectorOrganization Relationship Temporary Activation Code.

Ad Enter Your Tax Information. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Free 2-Day Shipping wAmazon Prime.

Failure to furnish Estimate Tax Payable Form CP204 - Liable to a fine ranging from RM200 to RM2000 or face imprisonment or both. Minimum amount of Tax Estimate Subsection 107C 3 of the ITA provides that the minimum amount of tax estimate for a year of assessment shall not less than 85 of the amount of the amendment of tax estimate or the tax estimate amount if no amendment of tax estimate is submitted for the immediate preceding year of assessment. An estimate of tax payable for a company limited liability partnership trust body or co-operative society that has commenced operations must not be less than 85 of the revised tax estimate or tax estimate if there is no revised tax estimate furnished for the immediately preceding YA.

Medicare levy surcharge Income Contingent Loan ICL repayments study and training loan repayments including Higher Education Loan Program HELP Student Start-up Loan SSL Student Financial Supplement Scheme SFSS and Trade Support Loan TSL. C The cessation of tax instalment payments in cases where the revised tax estimate Form CP204A is lower than the original tax estimate Form CP204 4. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

- Section 120 1 f Fails to pay the monthly tax estimate instalment by 15th of the month a late payment penalty of 10 will be imposed on the balance of tax instalment not paid for the month - Section 107C 9. The new Guidelines re-iterate that the relevant entities will not be allowed to submit the Form CP204 later than the stipulated due date if the Notice of Instalment Payments Form CP205 has been. The formula for calculating the amount of tax to be increased is as follows.

Ad Read Customer Reviews Find Best Sellers. For example if the Companys last CP204CP204A is RM10000 the tax estimate for initial submission must not be less than RM8500. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year.

The tax estimate must not be less than 85 of the revised tax estimate or tax estimate for the immediately preceding Year of Assessment.

Irbm S Guideline On Tax Estimate 3rd Month Revision And Deferment Cheng Co Group

Updated Guidelines For Submission Of Estimated Tax Payable Ey Malaysia

Investment Property Excel Spreadsheet Rental Property Investment Property Rental Property Investment

Malaysia Taxation Junior Diary 4 Estimation Of Tax Payable Cp 204

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Computation Of Income Tax In Excel Excel Skills

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

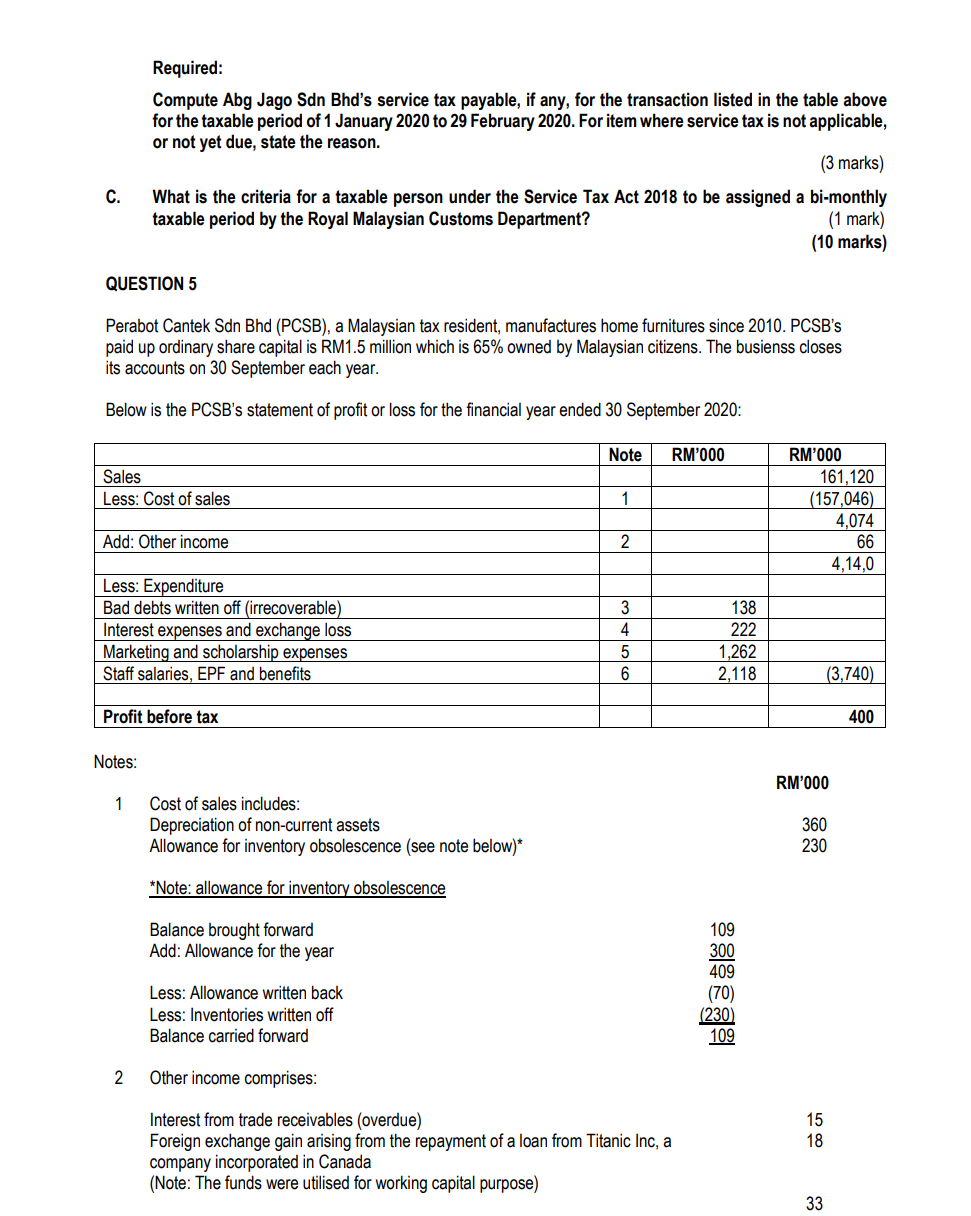

Section B All Six Questions Are Compulsory And Must Chegg Com

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Computation Of Income Tax In Excel Excel Skills

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Tax Calculation Spreadsheet Excel Formula Spreadsheet Spreadsheet Template

Accrued Income Tax Double Entry Bookkeeping

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel